Candlestick Patterns Spinning Top

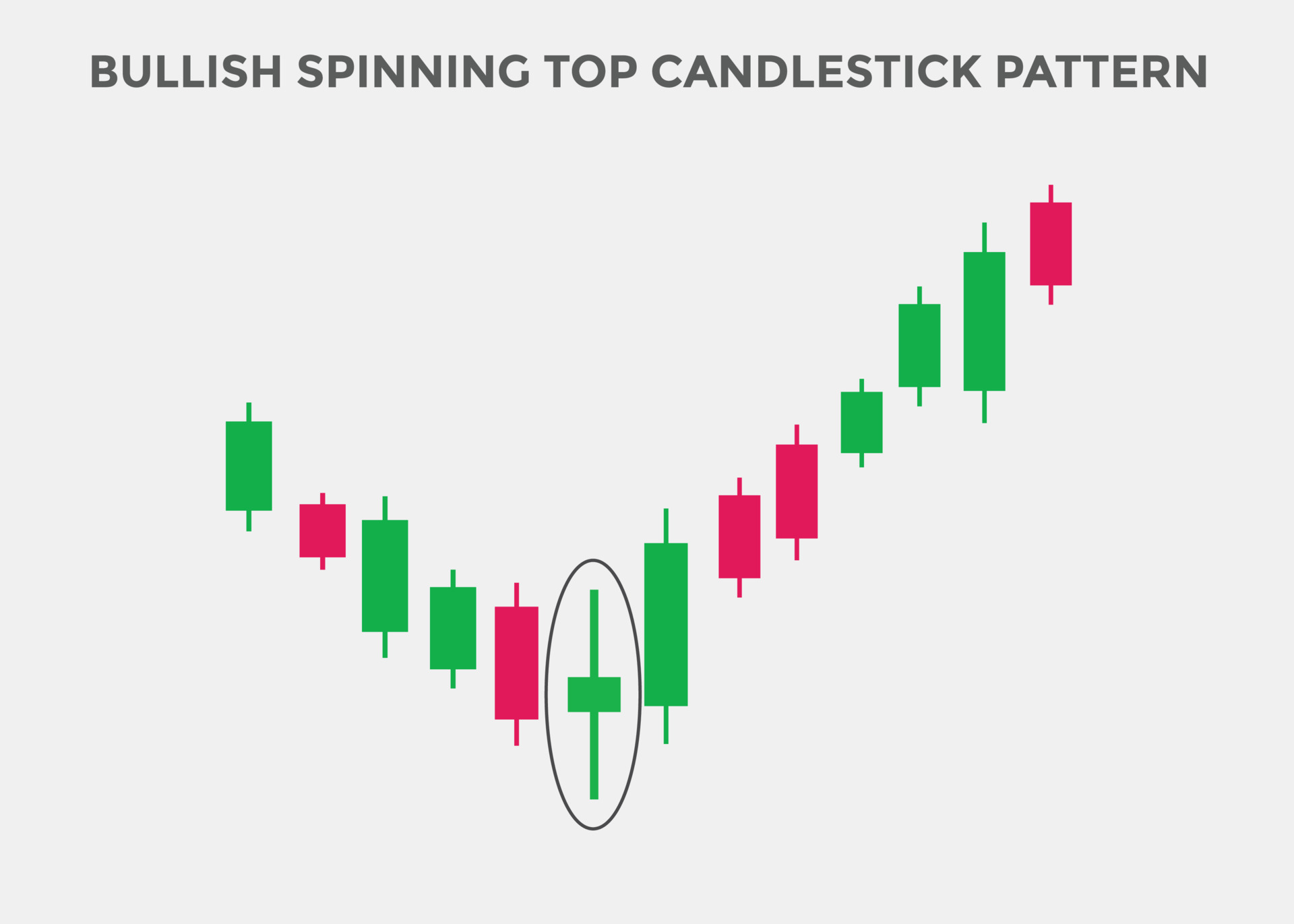

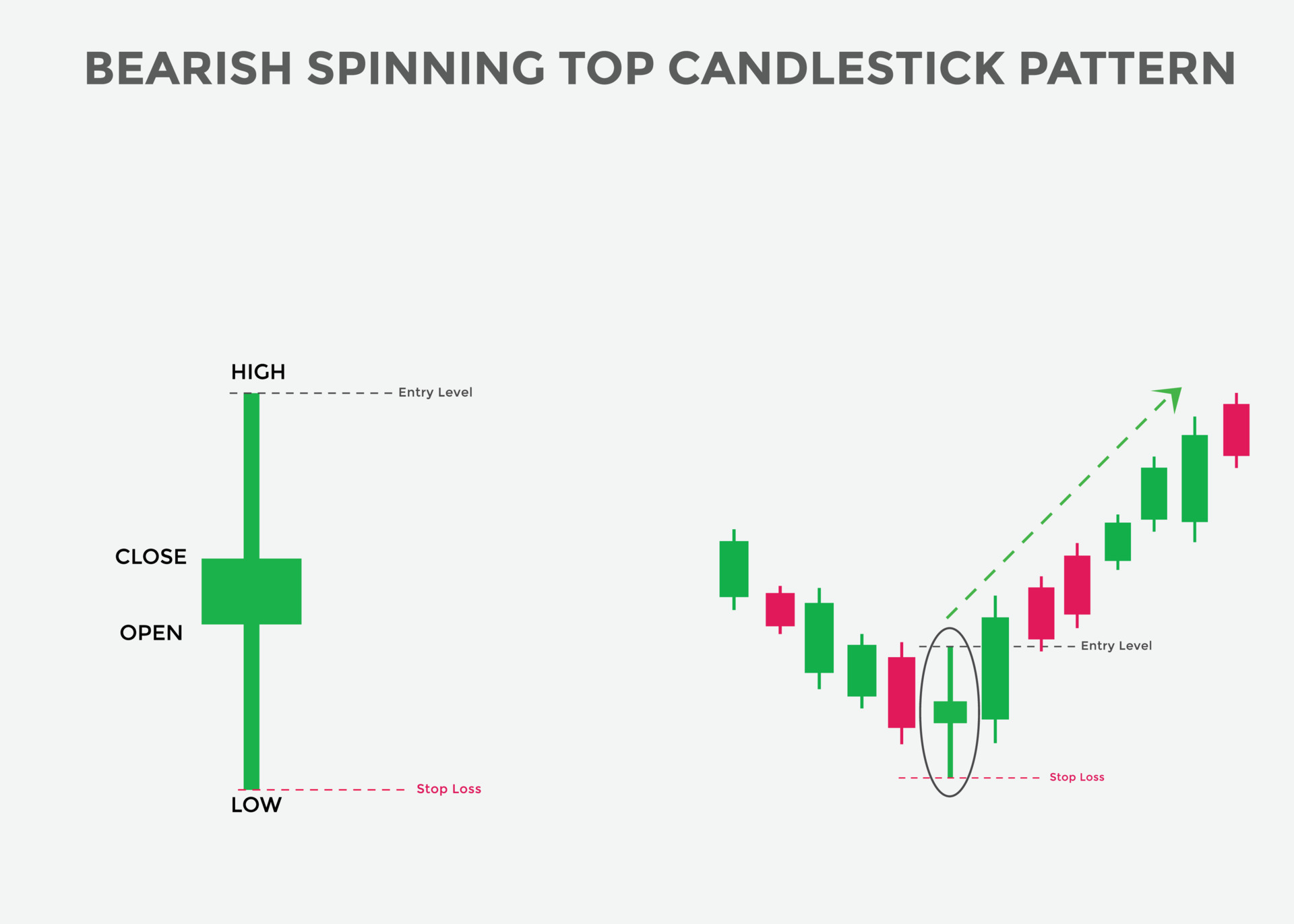

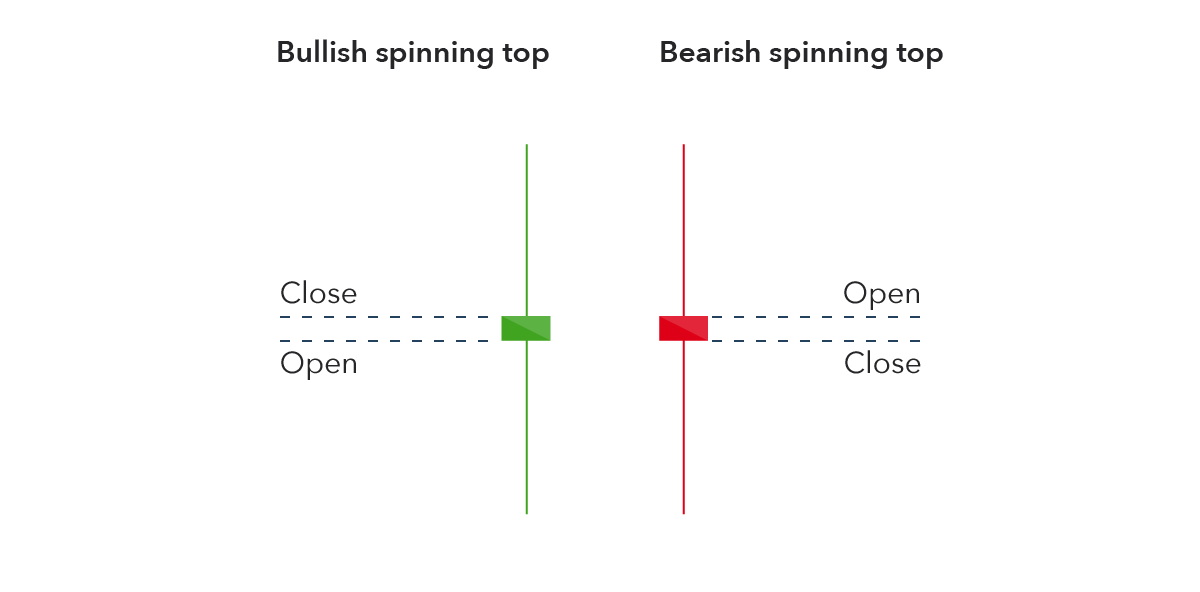

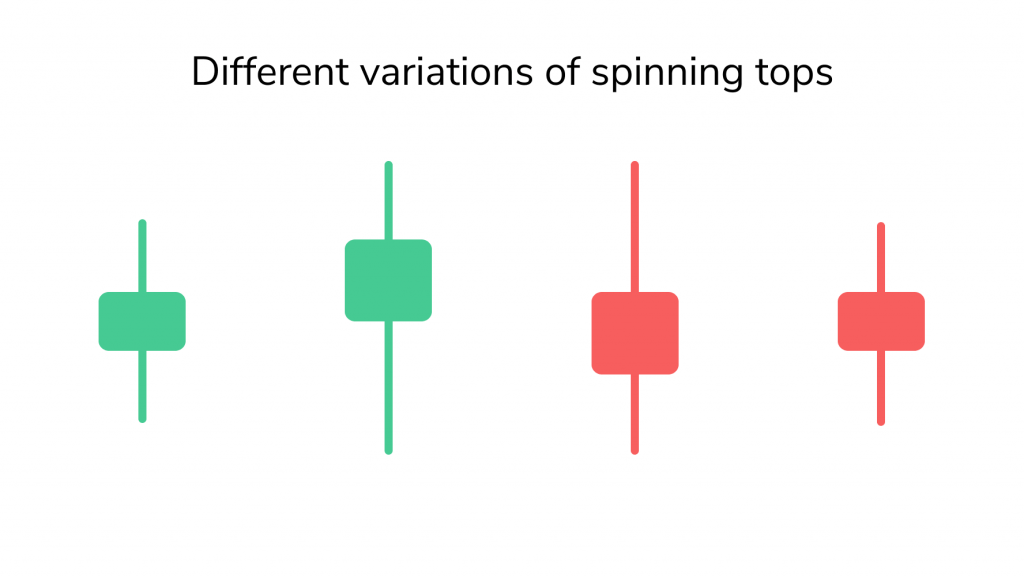

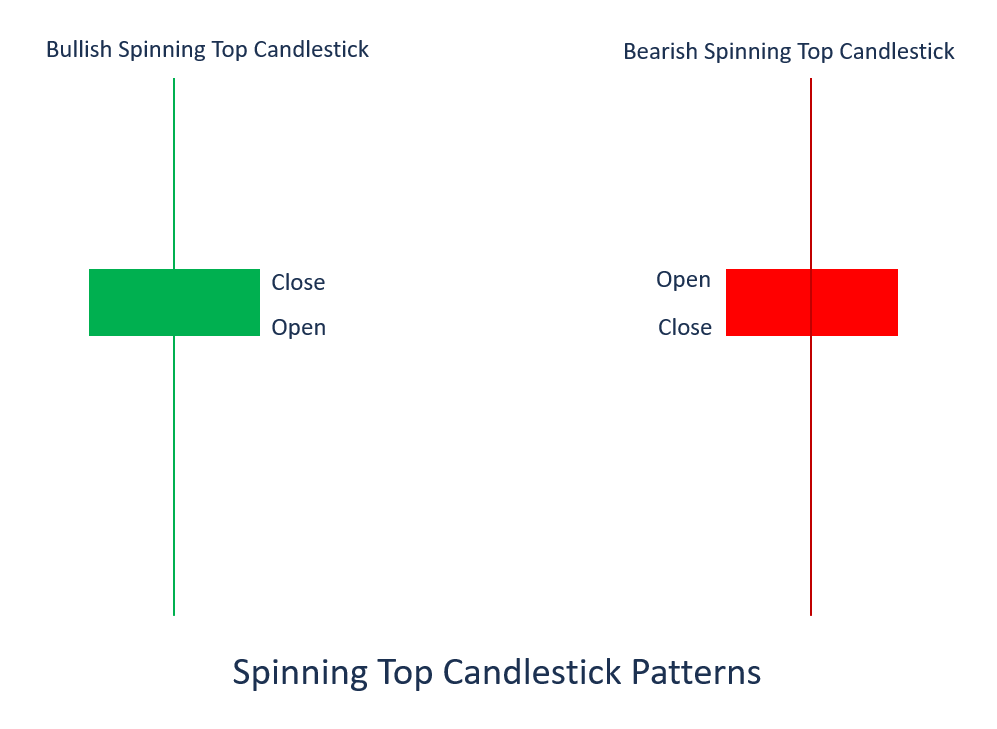

Candlestick Patterns Spinning Top - The bears, of course, don’t like this. Web a spinning top is a single candlestick pattern which represents indecision about the future price movement. It has a small body closing in the middle of the candle’s range, with long wicks on both sides. Spinning top candlestick is a pattern with a short body between an upper and a lower long wick. Locate candle with a short body and long wicks on both sides; Web read about the spinning top candlestick chart pattern, including what causes it to form and how to identify it. The wicks show the highest and lowest prices reached during the trading session…. The spinning top candlestick pattern has a short body centred between wicks of equal length. Similar to a doji pattern, a spinning top is considered a neutral pattern, although many do end in reversals. Web key takeaways for trading the spinning top candlestick pattern: The bulls sent the price higher, while the bears pushed it low again. Spinning tops form when the bulls and bears battle for control of price, but neither side can overwhelm the other. Web the spinning top candlestick is a fascinating puzzle for traders seeking crucial market insights! Our girls will be 4 (turning 5) and 2 1/2. We are looking into a december 2013 disney stay. First, the bulls push price beyond the open, causing the candle to turn bullish. By examining the shape and color of the candlestick, traders can gauge market sentiment and potential future movements. A small real body means that the open price and close price are close to each other. You’ll also learn how to trade when you spot the spinning top pattern. Its ability to identify market indecision and pauses in price movements makes it a truly invaluable tool in your trading arsenal. This candlestick pattern has a short real body with long upper and lower shadows of almost equal lengths. Similar to a doji pattern, a spinning top is considered a neutral pattern, although many do end in reversals. Web jan 10, 2017 •. First, the bulls push price beyond the open, causing the candle to turn bullish. Web known as spinning. The japanese candlestick chart patterns are the most popular way of reading trading charts. It's characterized by a small body situated between long upper and lower wicks. First, the bulls push price beyond the open, causing the candle to turn bullish. The candlestick pattern represents indecision about the. It is another common and effective candlestick reversal pattern used by traders. Spinning top candlestick is a pattern with a short body between an upper and a lower long wick. Web a spinning top is a candlestick formation that signals indecision regarding the future trend direction. Web spinning top candlestick patterns are indicative of market uncertainty regarding future price movements. It has a small body closing in the middle of the candle’s. First, the bulls push price beyond the open, causing the candle to turn bullish. Web key takeaways for trading the spinning top candlestick pattern: A small real body means that the open price and close price are close to each other. Web a spinning top candlestick is a type of japanese candlestick charting pattern that traders use to analyze price. We are looking into a december 2013 disney stay. Similar to a doji pattern, a spinning top is considered a neutral pattern, although many do end in reversals. They emerge when bullish and bearish forces, speculating on price rise and decline, respectively, are evenly matched, resulting in a minimal net price change. It's characterized by a small body situated between. The candlestick pattern represents indecision about the. These can help traders to identify a period of rest in the market, when there is market indecision or neutral price movement. They emerge when bullish and bearish forces, speculating on price rise and decline, respectively, are evenly matched, resulting in a minimal net price change. Web the spinning top is a candlestick. A spinning top that is built to last forever. Web read about the spinning top candlestick chart pattern, including what causes it to form and how to identify it. While closely resembling a doji, a spinning top has small differences. The japanese candlestick chart patterns are the most popular way of reading trading charts. The candlestick pattern represents indecision about. Our girls will be 4 (turning 5) and 2 1/2. If a spinning top candlestick forms at the end of a head and shoulders pattern, look out for a bearish reversal coming. Web read about the spinning top candlestick chart pattern, including what causes it to form and how to identify it. Web 4.5 top 3 continuation candlestick patterns. This. Its ability to identify market indecision and pauses in price movements makes it a truly invaluable tool in your trading arsenal. It's characterized by a small body situated between long upper and lower wicks. The body represents the range between the open and close prices…. The bears, of course, don’t like this. Web a spinning top is a candlestick pattern. Web known as spinning top candlesticks, they signal indecision in the market. Web a spinning top candlestick is a type of japanese candlestick charting pattern that traders use to analyze price behavior in financial markets. While closely resembling a doji, a spinning top has small differences. To confirm this reversal, see what pattern it is a part of. The wicks. Web a spinning top is a candlestick formation that signals indecision regarding the future trend direction. Locate candle with a short body and long wicks on both sides; The document discusses candlestick patterns and how to interpret them. Web a spinning top candlestick is a chart pattern that forms over a single session. Web a spinning top is a candlestick pattern that indicates uncertainty. To confirm this reversal, see what pattern it is a part of. Because they are simple to understand and tend to. The spinning top illustrates a scenario where neither the seller nor the buyer has gained. 3 likes • 913 views. They emerge when bullish and bearish forces, speculating on price rise and decline, respectively, are evenly matched, resulting in a minimal net price change. Spinning top candlestick is a pattern with a short body between an upper and a lower long wick. It is another common and effective candlestick reversal pattern used by traders to. Web candlesticks are created with a body and wicks (or shadows). Spinning tops form when the bulls and bears battle for control of price, but neither side can overwhelm the other. Web 4.5 top 3 continuation candlestick patterns. If a spinning top candlestick forms at the end of a head and shoulders pattern, look out for a bearish reversal coming.Trading with the Spinning Top Candlestick

Spinning Top Candlestick Pattern Overview, Formation, How To Trade

Spinning Top Candlestick Definition

Spinning Top Candlestick Patterns Cheat Sheet

Bullish Spinning top candlestick pattern. Spinning top Bullish

Trading with the Spinning Top Candlestick

Bullish Spinning top candlestick pattern. Spinning top Bullish

How to Trade with the Spinning Top Candlestick IG International

What is a Spinning Top Candlestick Pattern TradeSanta

Spinning Top Candlestick Pattern Forex Trading

Web Known As Spinning Top Candlesticks, They Signal Indecision In The Market.

The Bears, Of Course, Don’t Like This.

Web A Spinning Top Is A Candlestick Pattern With A Short Real Body That's Vertically Centered Between Long Upper And Lower Shadows.

By Examining The Shape And Color Of The Candlestick, Traders Can Gauge Market Sentiment And Potential Future Movements.

Related Post:

:max_bytes(150000):strip_icc()/dotdash_Final_Spinning_Top_Candlestick_Definition_and_Example_Nov_2020-01-9ebe4d0e8ccb482c92214128a29874de.jpg)