Hammer Pattern Stock

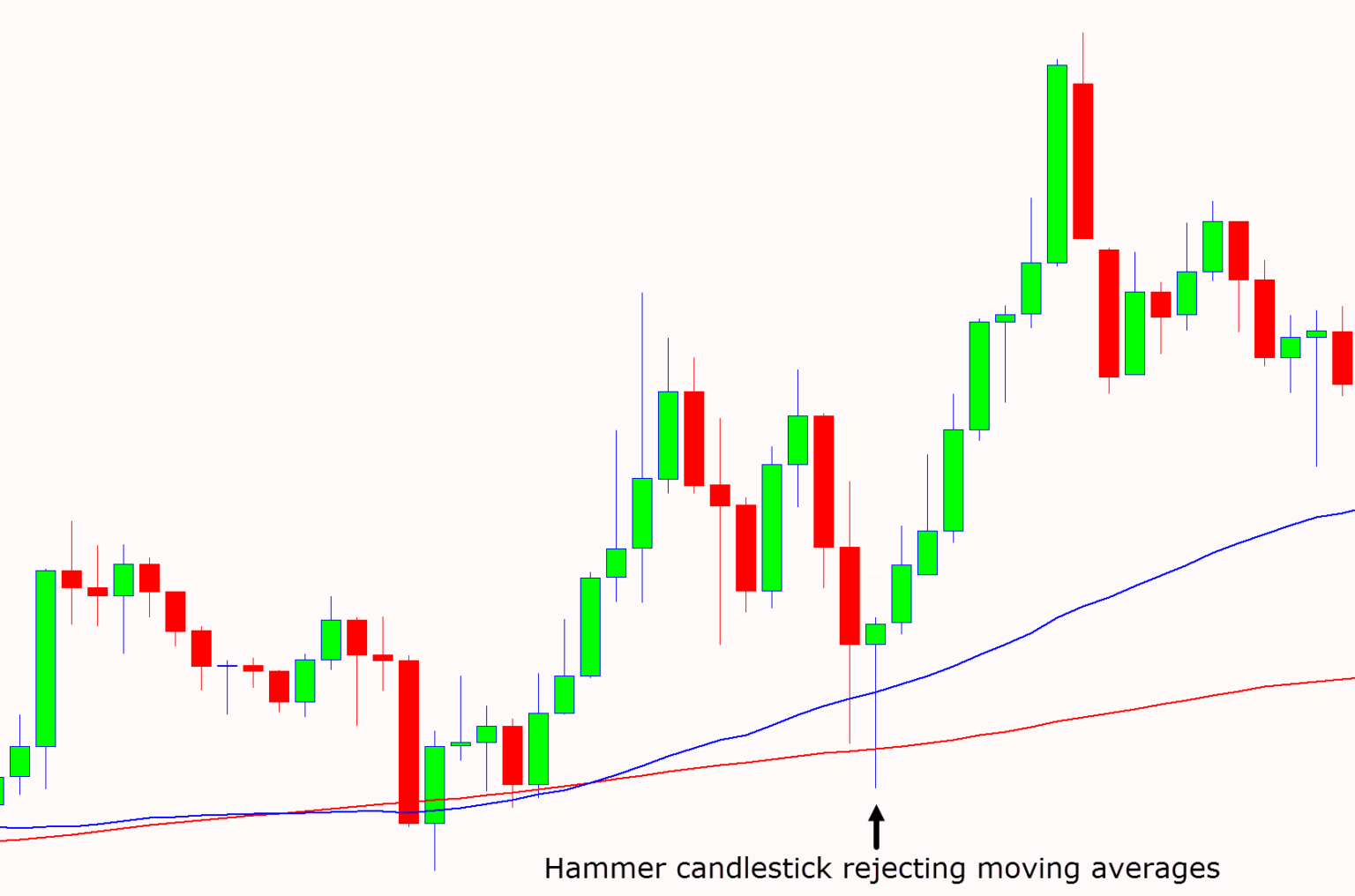

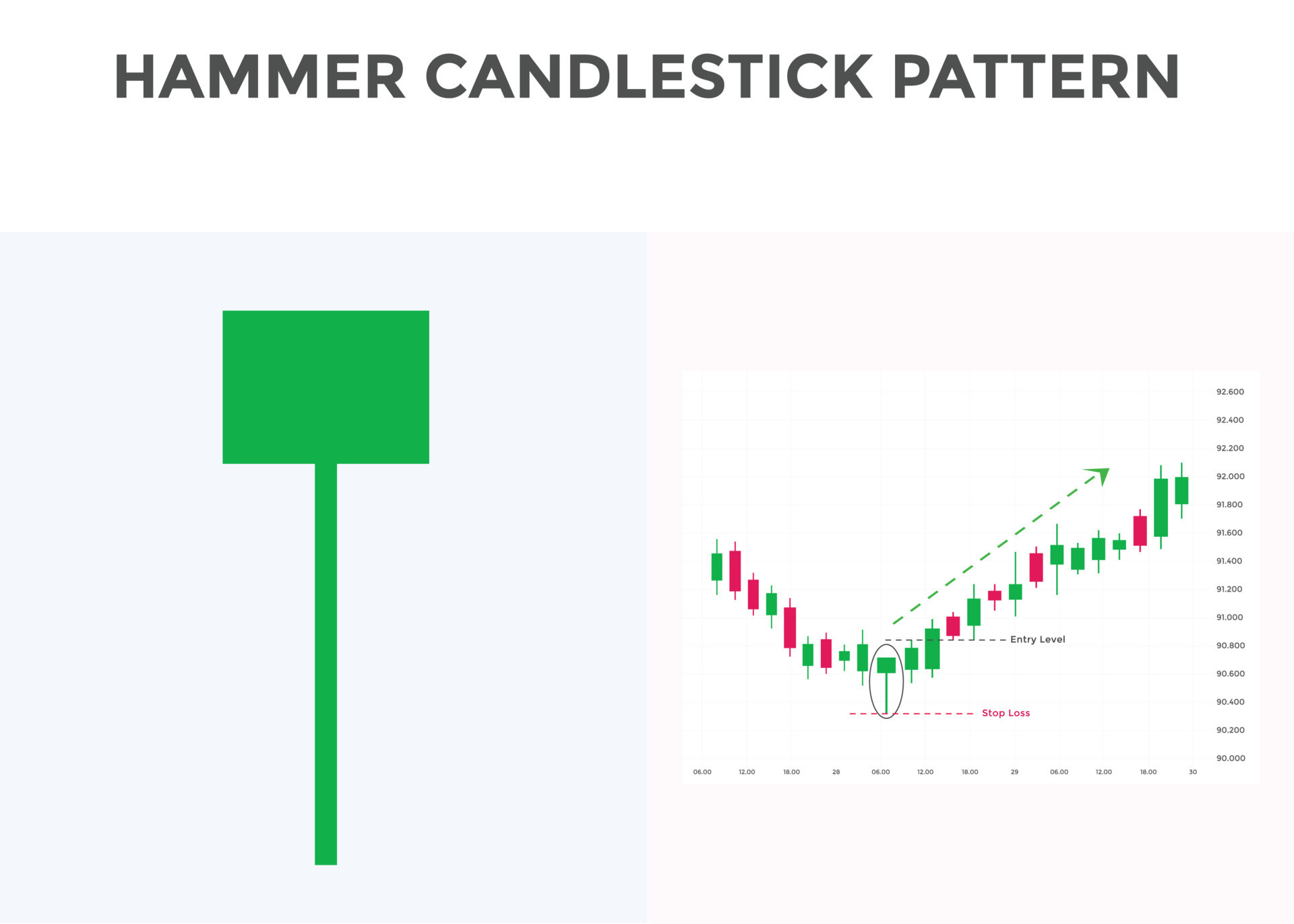

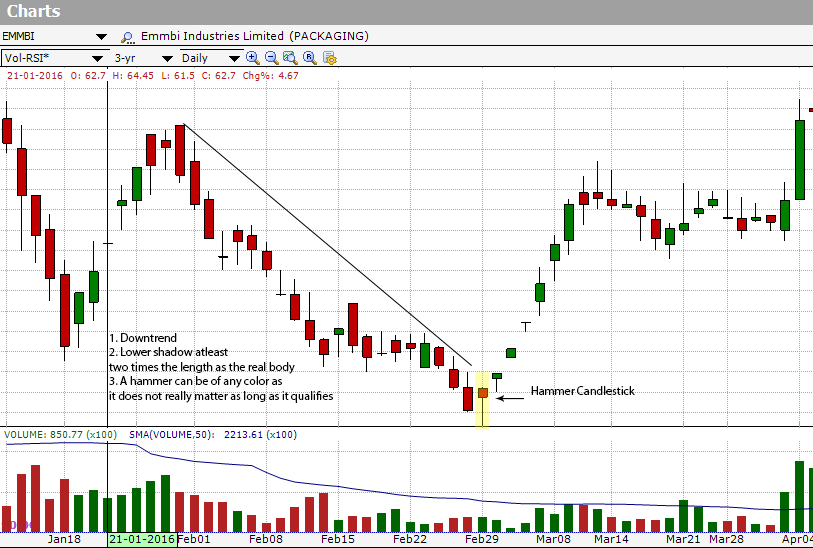

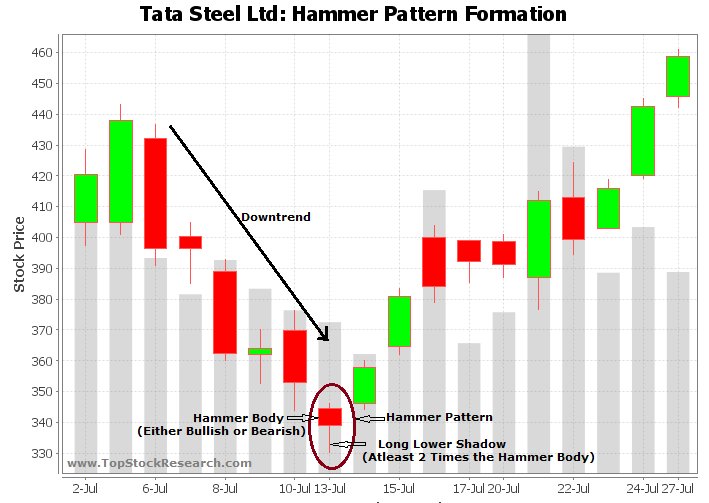

Hammer Pattern Stock - Web learn how to use the hammer candlestick pattern to spot a bullish reversal in the markets. It is a price pattern that usually occurs at the lower end of a down trend. A downtrend has been apparent in reddit inc. Web this pattern typically appears when a downward trend in stock prices is coming to an end, indicating a bullish reversal signal. They consist of small to medium size lower shadows, a real body, and little to no upper wick. Web the hammer is a single candlestick pattern that forms during a downtrend and signals a potential trend reversal. Web a downtrend has been apparent in reddit inc. If the candlestick is green or. It manifests as a single candlestick pattern appearing at the bottom of a downtrend and. In short, a hammer consists of a small real body that is found in the upper half of the candle’s range. Our guide includes expert trading tips and examples. What is a hammer candlestick? It manifests as a single candlestick pattern appearing at the bottom of a downtrend and. A hammer is a one day price pattern that occurs when a security trades significantly lower than its opening, but rallies later in the day to close either above or near its opening price. It’s a bullish reversal candlestick pattern, which indicates the end of a downtrend and the start of a new uptrend. If the candlestick is green or. Web the hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends. This shows a hammering out of a base and reversal setup. It signals that the market is about to change trend direction and advance to new heights. When you see a hammer candlestick, it's often seen as a positive sign for investors. It indicates that when sellers entered the market and pushed prices lower, buyers eventually outnumbered sellers and raised the asset’s price. While the stock has lost 6.2% over the past week, it could witness a trend reversal as a hammer chart pattern was formed in its last trading session. Web hammer candlesticks are a popular reversal pattern formation found at. They consist of small to medium size lower shadows, a real body, and little to no upper wick. It’s a bullish reversal candlestick pattern, which indicates the end of a downtrend and the start of a new uptrend. Web hammer candlesticks are a popular reversal pattern formation found at the bottom of downtrends. Web hammer technical & fundamental stock screener,. While the stock has lost 6.2% over the past week, it could witness a trend reversal as a hammer chart pattern was formed in its last. This is good news for investors because the u.s. Web this pattern typically appears when a downward trend in stock prices is coming to an end, indicating a bullish reversal signal. These candles are. The long lower shadow of the hammer shows that the stock attempted to sell off during the trading session, but the demand for shares helped bring the stock back up, closer to the opening price, with a green candle indicating the stock managed to close higher than. The price reached new lows but closed at a higher level due to. This pattern is typically seen as a bullish reversal signal, indicating that a downward price swing has likely reached its bottom and is poised to move higher. They consist of small to medium size lower shadows, a real body, and little to no upper wick. This is good news for investors because the u.s. It’s a bullish reversal candlestick pattern,. Web this pattern typically appears when a downward trend in stock prices is coming to an end, indicating a bullish reversal signal. While the stock has lost 6.2% over the past week, it could witness a trend reversal as a hammer chart pattern was formed in its last trading session. Our guide includes expert trading tips and examples. The body. Web the hammer candlestick pattern is formed when the stock opens at a higher price and then it gives up gains to trade at a price that is significantly lower than the opening price. Web stock investors should be ecstatic. The hammer helps traders visualize where support and demand are located. Web economists and traders analyze hammer candlestick patterns to. A downtrend has been apparent in reddit inc. The formation of a hammer. This pattern is typically seen as a bullish reversal signal, indicating that a downward price swing has likely reached its bottom and is poised to move higher. It is characterized by a small body and a long lower wick, resembling a hammer, hence its name. Web the. This is good news for investors because the u.s. This pattern is typically seen as a bullish reversal signal, indicating that a downward price swing has likely reached its bottom and is poised to move higher. Look for a break above the. Our guide includes expert trading tips and examples. They consist of small to medium size lower shadows, a. What is a hammer candlestick? This shows a hammering out of a base and reversal setup. It is characterized by a small body and a long lower wick, resembling a hammer, hence its name. Web the hanging man candlestick pattern is characterized by a short wick (or no wick) on top of small body (the candlestick), with a long shadow. Web the hammer is a single candlestick pattern that forms during a downtrend and signals a potential trend reversal. In candlestick charting, it points to a bullish reversal. The body of the candle is short with a longer lower shadow. Web learn how to use the hammer candlestick pattern to spot a bullish reversal in the markets. A hammer is a one day price pattern that occurs when a security trades significantly lower than its opening, but rallies later in the day to close either above or near its opening price. Stock market on average has produced the bulk of its gains when congress is in recess. This shows a hammering out of a base and reversal setup. When you see a hammer candlestick, it's often seen as a positive sign for investors. It manifests as a single candlestick pattern appearing at the bottom of a downtrend and. Web this candlestick pattern is a bullish reversal single candle pattern, which indicates a downtrend reversal in a stock price. They consist of small to medium size lower shadows, a real body, and little to no upper wick. Web economists and traders analyze hammer candlestick patterns to understand price action and selling pressure in stock trading, forex trading (foreign exchange trading), and other marketplaces. Web the hanging man candlestick pattern is characterized by a short wick (or no wick) on top of small body (the candlestick), with a long shadow underneath. Web a downtrend has been apparent in reddit inc. If the candlestick is green or. It consists of a small real body that emerges after a significant drop in price.Hammer Patterns Chart 5 Trading Strategies for Forex Traders

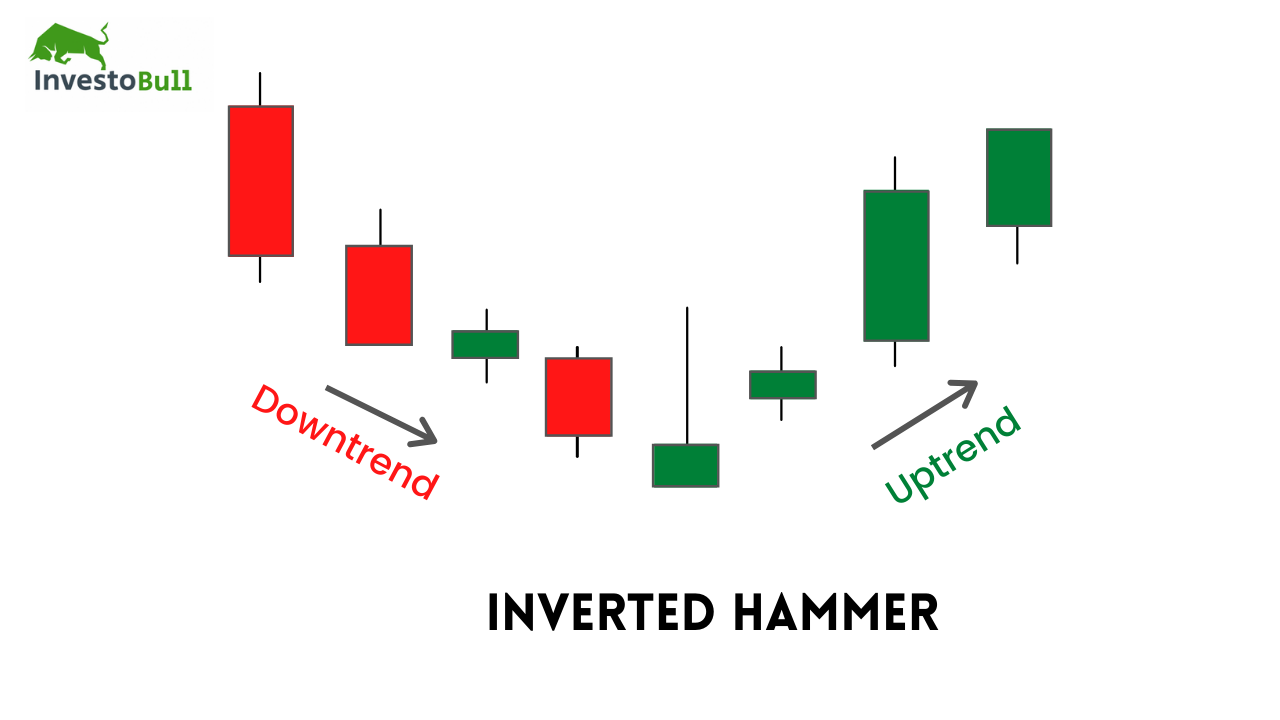

What is Hammer Candlestick Pattern June 2024

How to trade Hammer Candlestick Pattern 2024 CoinCodeCap Crypto Signals

Hammer Candlestick Pattern Trading Guide

Hammer pattern candlestick chart pattern. Bullish Candlestick chart

Hammer, Inverted Hammer & Hanging Man Candlestick Chart Patterns

Tutorial on Hammer Candlestick Pattern

Powerful Hammer Candlestick Pattern Formation, Example and

Hammer Candlestick Pattern Trading Guide

Hammer Candlestick Pattern A Powerful Reversal Signal Forex

Web The Hammer Candle Is Another Japanese Candlestick Pattern Among These 35 Powerful Candlestick Patterns.

The Hammer Candle Typically Appears At The End Of A Downtrend, Indicating A Potential Reversal In Price Movement.

Web The Hammer Candlestick Is A Significant Pattern In The Realm Of Technical Analysis, Vital For Predicting Potential Price Reversals In Markets.

The Long Lower Shadow Of The Hammer Shows That The Stock Attempted To Sell Off During The Trading Session, But The Demand For Shares Helped Bring The Stock Back Up, Closer To The Opening Price, With A Green Candle Indicating The Stock Managed To Close Higher Than.

Related Post: