Inverse Head And Shoulders Pattern

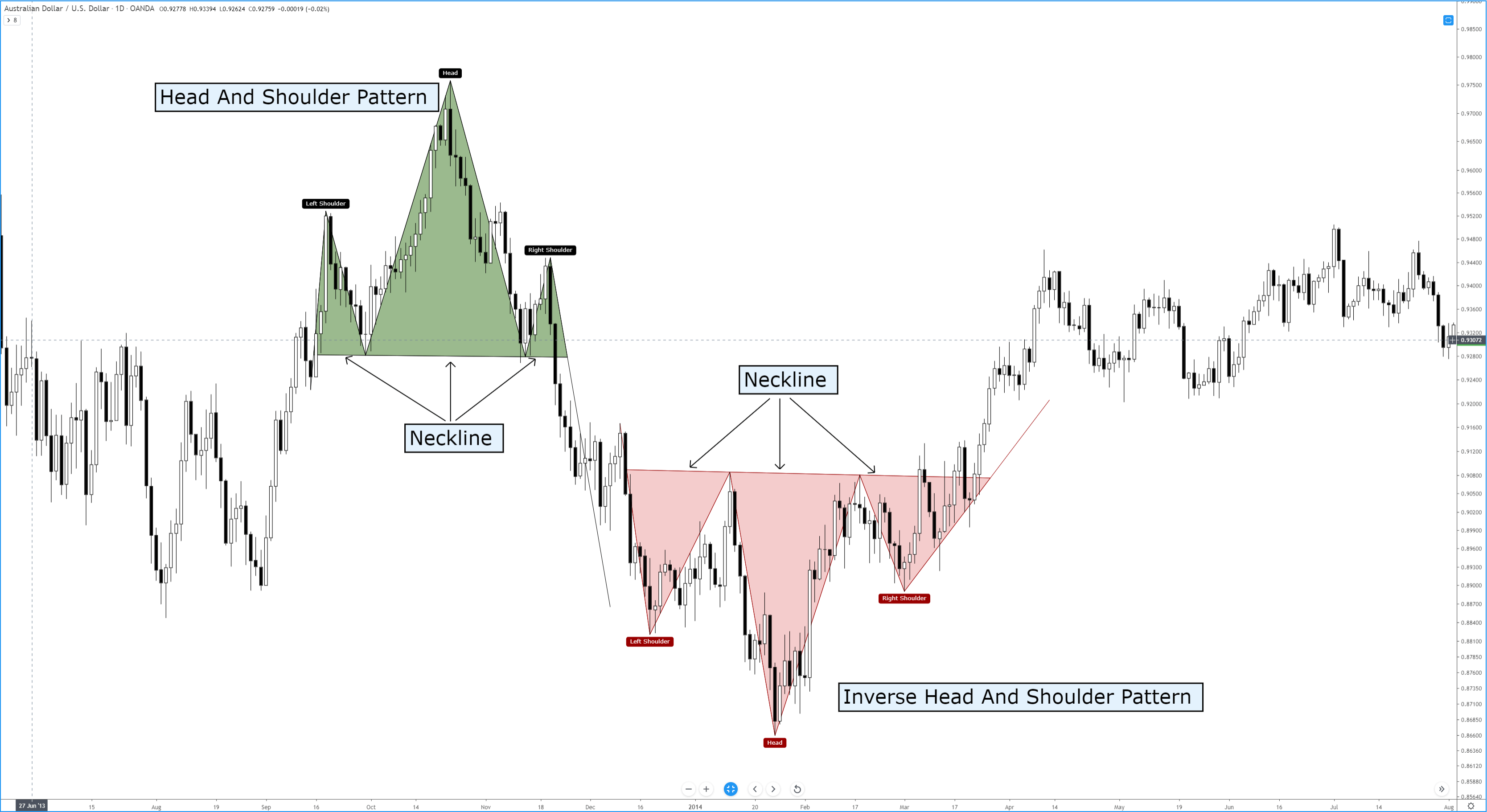

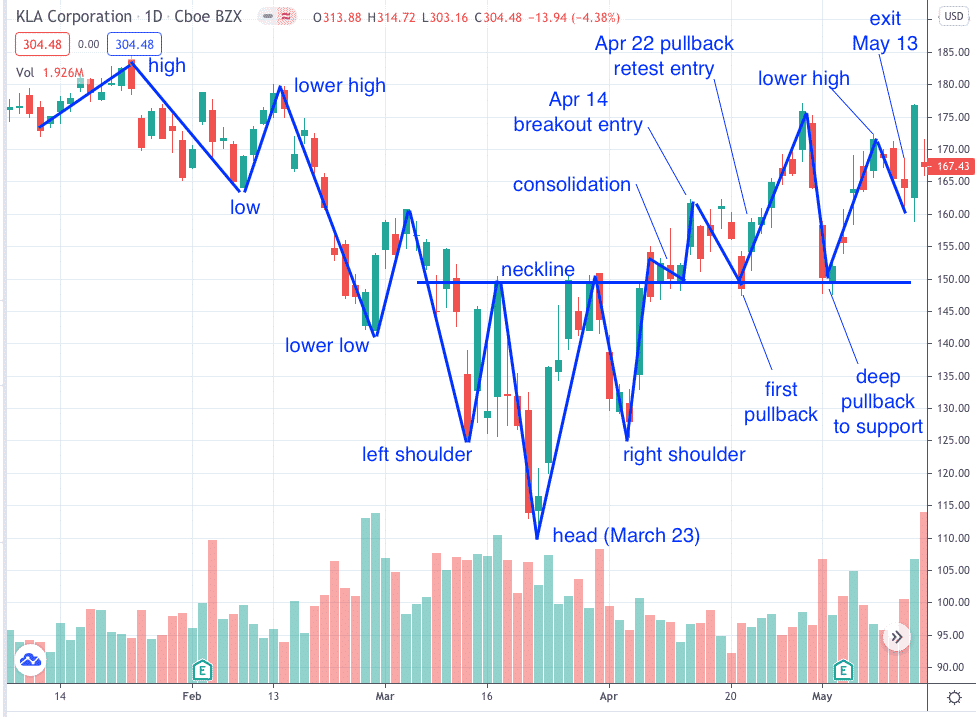

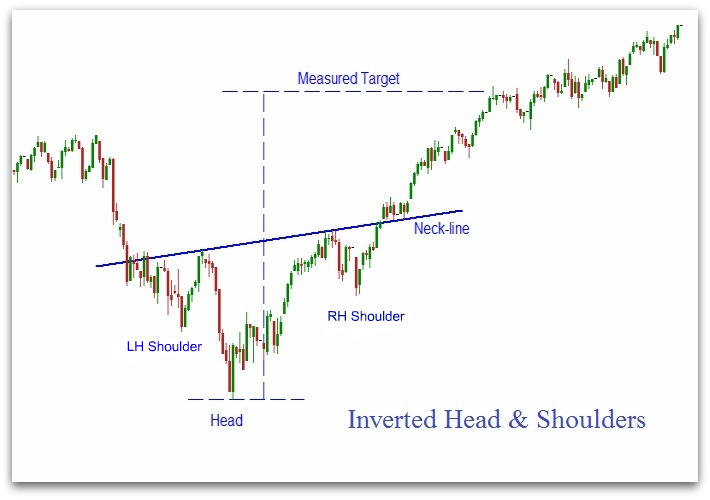

Inverse Head And Shoulders Pattern - Following this, the price generally goes to the upside and starts a new uptrend. It occurs when the price hits new lows on three separate occasions, with two lows forming the shoulders and the central trough forming the head. The opposite of a head and shoulders chart is the inverse head and shoulders, also called a head and shoulders bottom. Web the inverse head and shoulders, or the head and shoulders bottom, is a popular chart pattern used in technical analysis. It is the opposite version of the head and shoulders pattern (which is a bearish reversal pattern) and has a similar structure and logic as the. This pattern is formed when an asset’s price creates a low (the “left shoulder”), followed by a lower low (the “head”), and then a higher low (the “right shoulder”). Web the head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend is exhausted. Web an inverse head and shoulders pattern is a technical analysis pattern that signals a potential trend reversal in a downtrend. The pattern consists of 3. It represents a bullish signal suggesting a potential reversal of a current downtrend. Web an inverse head and shoulders pattern is a technical analysis pattern that signals a potential trend reversal in a downtrend. The opposite of a head and shoulders chart is the inverse head and shoulders, also called a head and shoulders bottom. Web an inverse head and shoulders, also called a head and shoulders bottom or a reverse head and shoulders, is inverted with the head and shoulders top used to predict reversals in downtrends. Web the head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend is exhausted. It is the opposite version of the head and shoulders pattern (which is a bearish reversal pattern) and has a similar structure and logic as the. Web an inverse head and shoulders is an upside down head and shoulders pattern and consists of a low, which makes up the head, and two higher low peaks that make up the left and right shoulders. Head & shoulder and inverse head & shoulder. The pattern consists of 3. It represents a bullish signal suggesting a potential reversal of a current downtrend. This reversal could signal an end of an uptrend or downtrend. It is inverted with the head. The opposite of a head and shoulders chart is the inverse head and shoulders, also called a head and shoulders bottom. Web the inverse head and shoulders pattern is a bullish candlestick formation that occurs at the end of a downward trend and potentially signals the end of a trend and the beginning of. Web the head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend is exhausted. Web an inverse head and shoulders pattern is a technical analysis pattern that signals a potential trend reversal in a downtrend. The pattern consists of 3. Web inverse head and shoulders. Web the. Web the inverse head and shoulders pattern is a bullish candlestick formation that occurs at the end of a downward trend and potentially signals the end of a trend and the beginning of a new upward trend. Web an inverse head and shoulders is an upside down head and shoulders pattern and consists of a low, which makes up the. Web the inverse head and shoulders pattern is a bullish candlestick formation that occurs at the end of a downward trend and potentially signals the end of a trend and the beginning of a new upward trend. Web an inverse head and shoulders is an upside down head and shoulders pattern and consists of a low, which makes up the. It is the opposite version of the head and shoulders pattern (which is a bearish reversal pattern) and has a similar structure and logic as the. Web the inverse head and shoulders pattern is a bullish candlestick formation that occurs at the end of a downward trend and potentially signals the end of a trend and the beginning of a. Web the inverse head and shoulders pattern is a bullish candlestick formation that occurs at the end of a downward trend and potentially signals the end of a trend and the beginning of a new upward trend. Web the inverse head and shoulders pattern is one of the most accurate technical analysis reversal patterns, with a reliability of 89%. Web. It is the opposite version of the head and shoulders pattern (which is a bearish reversal pattern) and has a similar structure and logic as the. This pattern is formed when an asset’s price creates a low (the “left shoulder”), followed by a lower low (the “head”), and then a higher low (the “right shoulder”). It is inverted with the. It represents a bullish signal suggesting a potential reversal of a current downtrend. It is of two types: The right shoulder on these patterns typically is higher than the left, but many times it’s equal. The pattern consists of 3. Web the inverse head and shoulders, or the head and shoulders bottom, is a popular chart pattern used in technical. Web the head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend is exhausted. Web the inverse head and shoulders pattern is a reversal pattern in stock trading. The opposite of a head and shoulders chart is the inverse head and shoulders, also called a head and. Web the inverse head and shoulders pattern is a bullish candlestick formation that occurs at the end of a downward trend and potentially signals the end of a trend and the beginning of a new upward trend. Web an inverse head and shoulders pattern is a technical analysis pattern that signals a potential trend reversal in a downtrend. Web the. Web the inverse head and shoulders pattern is a reversal pattern in stock trading. Web an inverse head and shoulders pattern is a technical analysis pattern that signals a potential trend reversal in a downtrend. Following this, the price generally goes to the upside and starts a new uptrend. Web inverse head and shoulders. Web the head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend is exhausted. Head & shoulder and inverse head & shoulder. It is inverted with the head. The opposite of a head and shoulders chart is the inverse head and shoulders, also called a head and shoulders bottom. It occurs when the price hits new lows on three separate occasions, with two lows forming the shoulders and the central trough forming the head. This reversal could signal an end of an uptrend or downtrend. Web the inverse head and shoulders, or the head and shoulders bottom, is a popular chart pattern used in technical analysis. It is the opposite version of the head and shoulders pattern (which is a bearish reversal pattern) and has a similar structure and logic as the. The pattern consists of 3. Web an inverse head and shoulders, also called a head and shoulders bottom or a reverse head and shoulders, is inverted with the head and shoulders top used to predict reversals in downtrends. Web an inverse head and shoulders is an upside down head and shoulders pattern and consists of a low, which makes up the head, and two higher low peaks that make up the left and right shoulders. Web the inverse head and shoulders pattern is a bullish candlestick formation that occurs at the end of a downward trend and potentially signals the end of a trend and the beginning of a new upward trend.Pattern In A Chart Double Tops & Bottoms, Head and Shoulders, Wedge

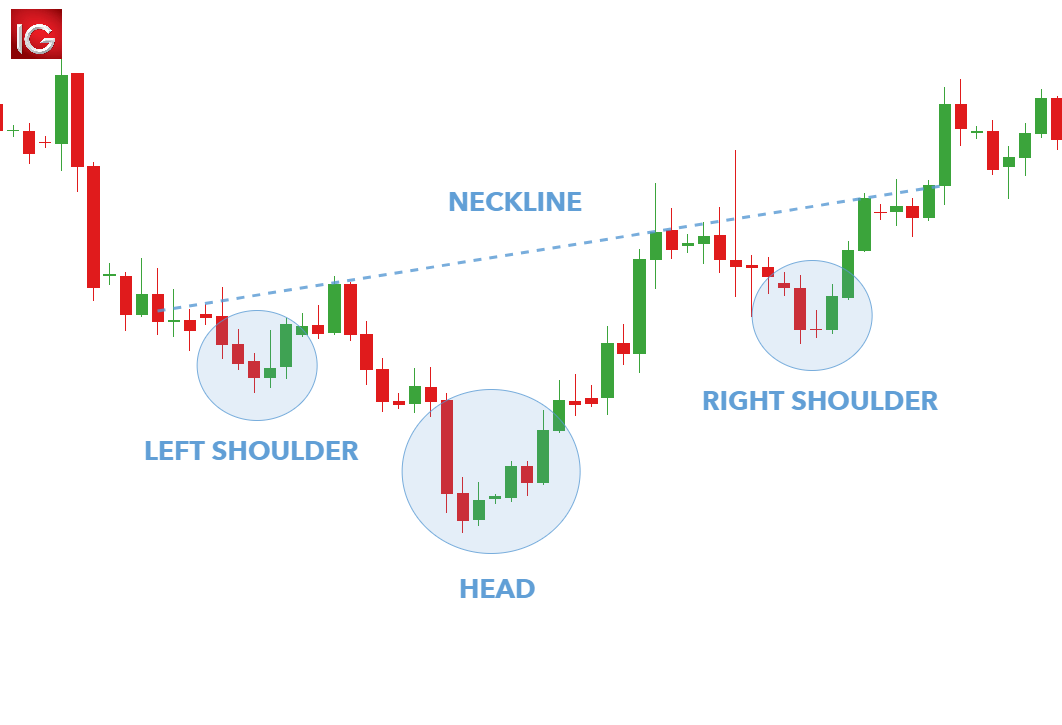

INVERSE HEAD and SHOULDERS Chart Pattern

The Head and Shoulders Pattern A Trader’s Guide

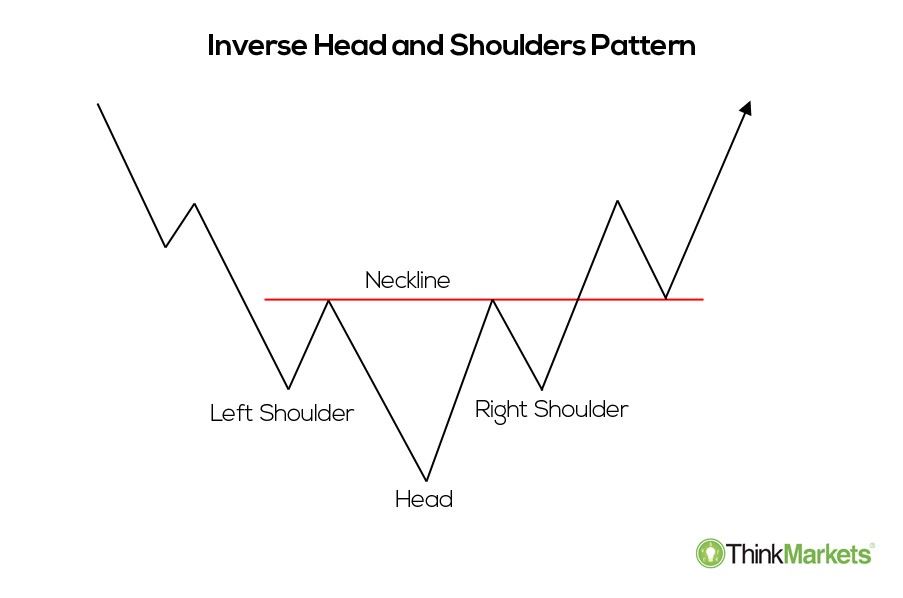

Head and Shoulders Trading Patterns ThinkMarkets EN

How to Use Head and Shoulders Pattern (Chart Pattern Part 1)

How To Trade Blog What is Inverse Head and Shoulders Pattern

Inverse Head and Shoulders Chart Pattern in 2020 Trading charts

Chart Patterns The Head And Shoulders Pattern Forex Academy

Inverse Head and Shoulders Pattern How To Spot It

Inverse Head And Shoulders Chart Pattern A Visual Reference of Charts

Web The Inverse Head And Shoulders Pattern Is One Of The Most Accurate Technical Analysis Reversal Patterns, With A Reliability Of 89%.

The Right Shoulder On These Patterns Typically Is Higher Than The Left, But Many Times It’s Equal.

This Pattern Is Formed When An Asset’s Price Creates A Low (The “Left Shoulder”), Followed By A Lower Low (The “Head”), And Then A Higher Low (The “Right Shoulder”).

It Is Of Two Types:

Related Post: