Megaphone Chart Pattern

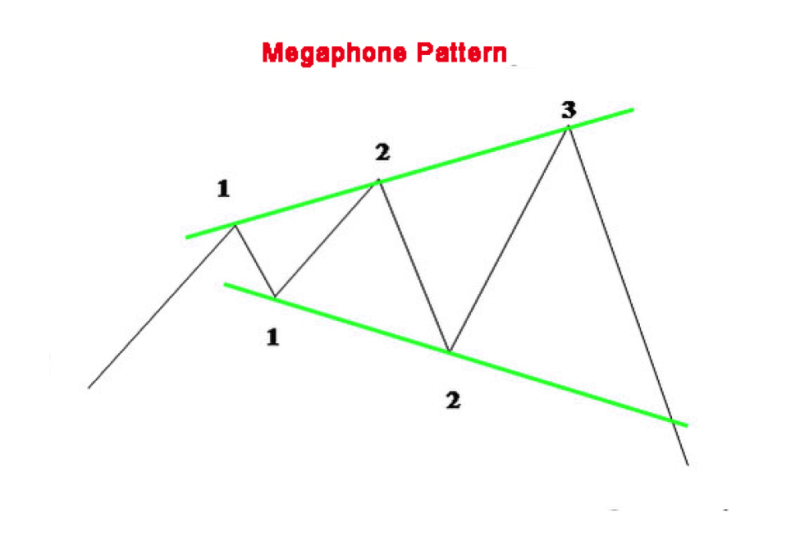

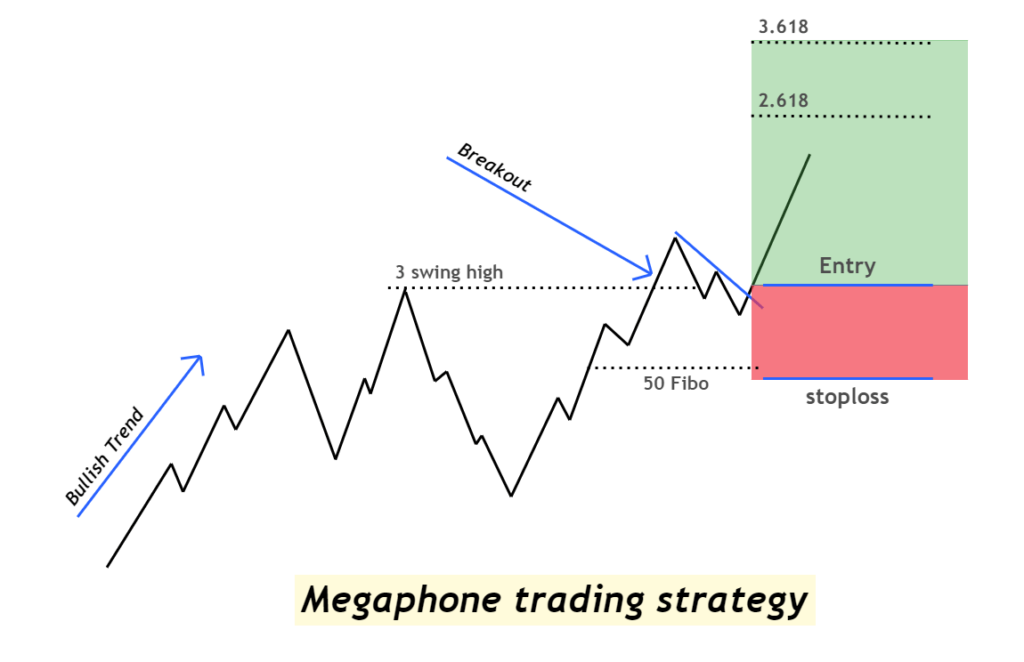

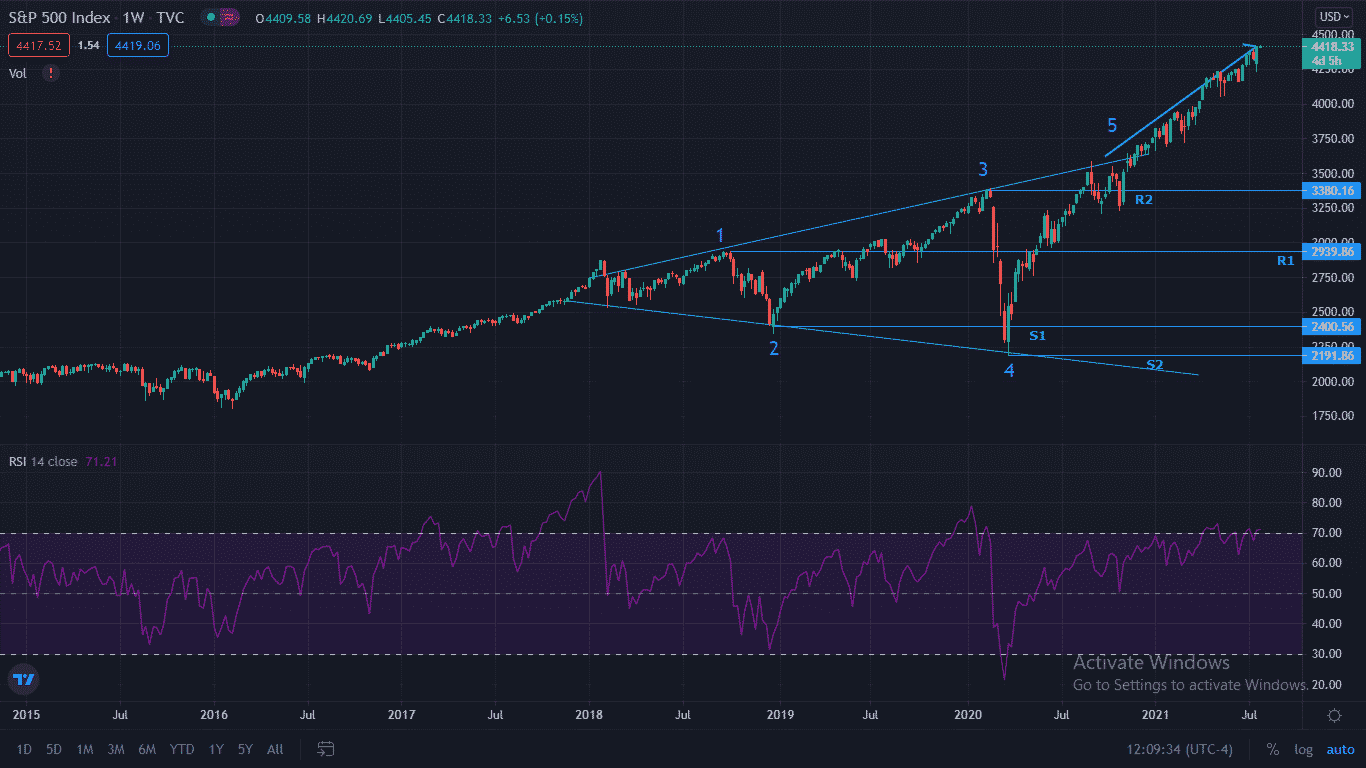

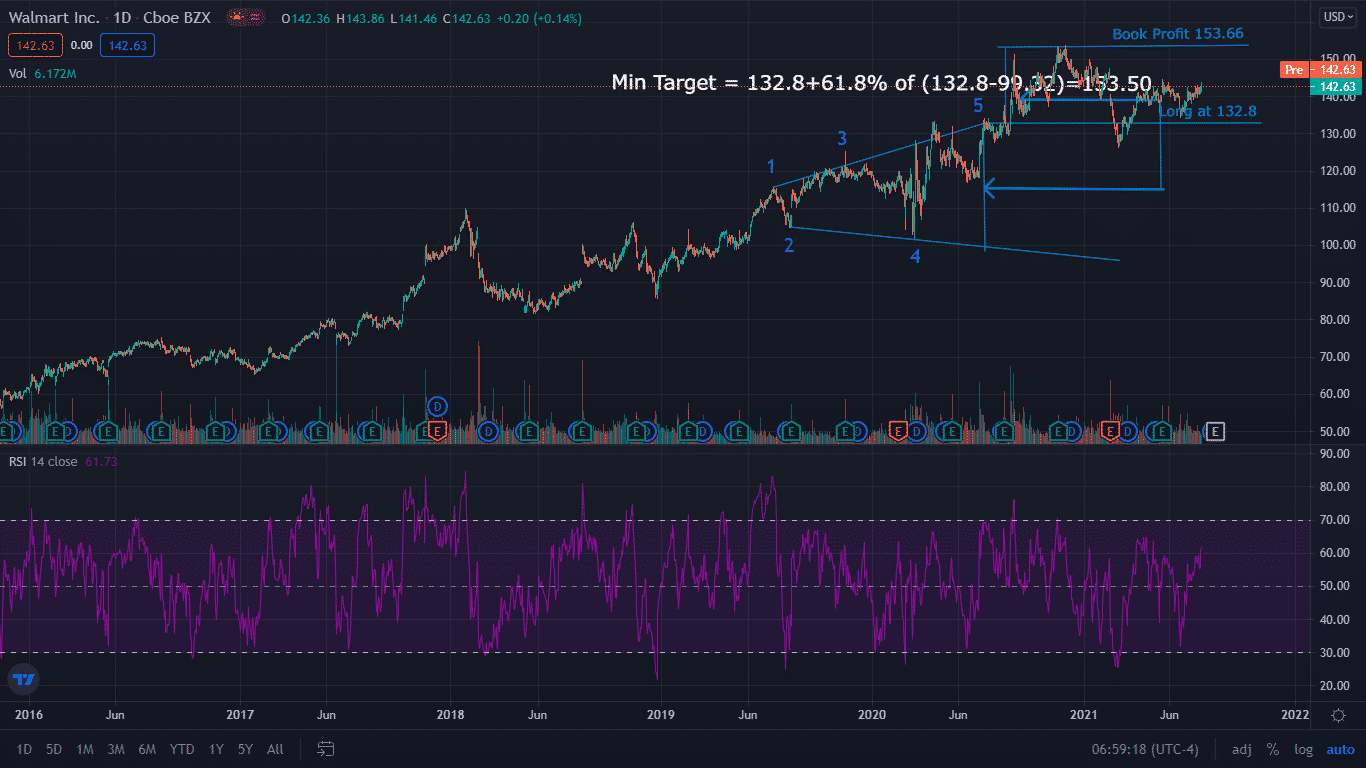

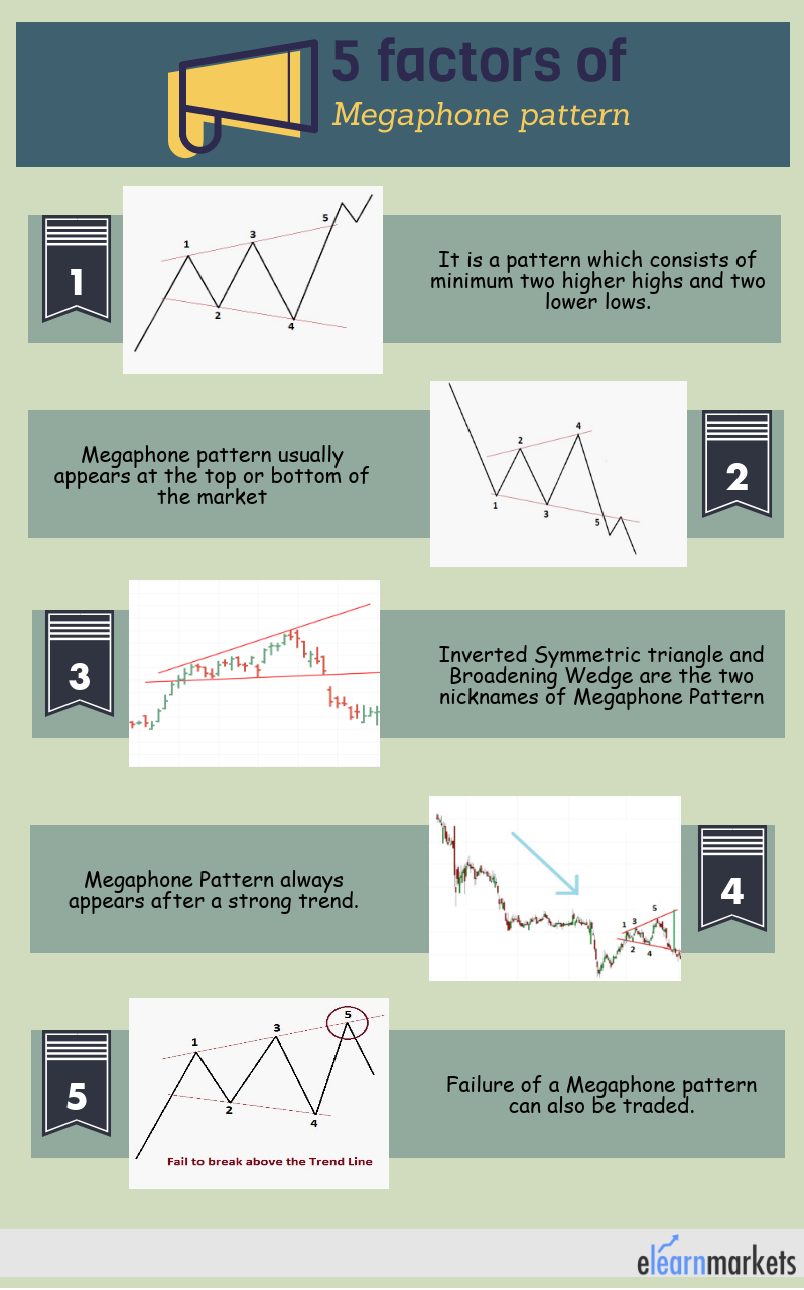

Megaphone Chart Pattern - Broadening pattern—can be recognized by its successively higher highs and lower lows, which form after a downward move. Web the megaphone pattern, also known as the broadening formation, is a technical chart pattern that signifies increased volatility and uncertainty in the market. Trading the breakout as a megaphone continuous pattern and trading the reversal as a megaphone reversal pattern. While it's rare, it can tell you a lot about where a stock is. The move to $69,000 would erase $261.9 million in short positions, as per coinglass data. Web “bitcoin next point to complete the weekly megaphone price pattern is $69k,” crypto trader milkybull crypto claimed. This can be both a bullish or bearish pattern depending on whether it’s sloping upwards or downwards. To explain it simply, the megaphone pattern is a chart pattern brought on by periods of high volatility in a given instrument. This pattern is characterized by a series of higher highs and lower lows, creating a shape that resembles a megaphone or a broadening wedge. They are considered both reversal and continuation patterns. Web megaphone pattern is a pattern which consists of minimum two higher highs and two lower lows. A series of higher highs and lower lows considered as pivot levels feature in such a pattern. Trades are placed after price reverses from the 5th swing pivot level. Traders are noticing several bullish indicators Web the megaphone pattern is a price action trading pattern that gets formed due to increasing volatility in prices. Is a megaphone pattern bullish or bearish? Web megaphone patterns present two trading opportunities: Each has a proven success rate. It consists of two trend lines diverging from each other in opposite directions. The pattern is generally formed when the market is highly volatile in nature and traders are not confident about the market direction. Web the megaphone pattern is a price action trading pattern that gets formed due to increasing volatility in prices. Web a broadening formation is a technical chart pattern depicting a widening channel of high and low levels of support and resistance. Web in this article you’ll learn about the ways to identify a megaphone pattern, whether a megaphone pattern is. Trading the breakout as a megaphone continuous pattern and trading the reversal as a megaphone reversal pattern. Web how to identify megaphone pattern stocks—are they bullish or bearish? Web the megaphone pattern is a price action trading pattern that gets formed due to increasing volatility in prices. Each has a proven success rate. A megaphone pattern consists of a minimum. A series of higher highs and lower lows considered as pivot levels feature in such a pattern. Web a megaphone pattern is when price action makes a series of higher highs and lower lows over a period of time. Each has a proven success rate. Web the megaphone pattern is a relatively unique chart formation characterized by higher highs and. It is represented by two lines, one ascending and one descending, that diverge from each other. This pattern is characterized by a series of higher highs and lower lows, creating a shape that resembles a megaphone or a broadening wedge. The move to $69,000 would erase $261.9 million in short positions, as per coinglass data. A series of higher highs. One ascending and one descending, which form a shape resembling a megaphone. Web a megaphone pattern consists of a bunch of candlesticks that form a big sloping megaphone shaped pattern. Each has a proven success rate. Web the megaphone pattern, also known as the broadening formation, is a chart pattern that occurs in trading during periods of high volatility. Trades. The pattern is generally formed when the market is highly volatile in nature and traders are not confident about the market direction. Trades are placed after price reverses from the 5th swing pivot level. Each has a proven success rate. Web megaphone patterns present two trading opportunities: Web a megaphone pattern consists of a bunch of candlesticks that form a. It is represented by two lines, one ascending and one descending, that diverge from each other. Web published research shows the most reliable and profitable stock chart patterns are the inverse head and shoulders, double bottom, triple bottom, and descending triangle. The bullish pattern is confirmed when, usually on the third upswing, prices break above the prior high but fail. Traders are noticing several bullish indicators The pattern is generally formed when the market is highly volatile in nature and traders are not confident about the market direction. Though often seen as bearish due to its volatility and uncertainty, its historical performance makes it ambiguous. Web the megaphone pattern, also known as the broadening formation, is a technical chart pattern. Web what is megaphone chart pattern? One ascending and one descending, which form a shape resembling a megaphone. Megaphone patterns are one of the most useful price charts in stock trading and forex trading. Web how to identify megaphone pattern stocks—are they bullish or bearish? Web megaphone pattern is a pattern which consists of minimum two higher highs and two. Web how to identify megaphone pattern stocks—are they bullish or bearish? Web megaphone pattern is a pattern which consists of minimum two higher highs and two lower lows. Web the megaphone pattern, also known as the broadening formation, is a chart pattern that occurs in trading during periods of high volatility. The pattern is generally formed when the market is. Web a technical chart pattern recognized by analysts, known as a broadening formation or megaphone pattern, is characterized by expanding price fluctuation. Web the megaphone trading pattern, also known as a broadening wedge, inverted symmetrical triangle, or broadening formation, is a chart pattern characterised by its distinct shape resembling a megaphone or a cone. The pattern forms when price action makes a series of higher highs and lower lows, creating a widening trend line shape resembling a megaphone. Its key components are two diverging trendlines: Is a megaphone pattern bullish or bearish? Trading the breakout as a megaphone continuous pattern and trading the reversal as a megaphone reversal pattern. One ascending and one descending, which form a shape resembling a megaphone. Web a broadening top is a unique chart pattern resembling a reverse triangle or megaphone that signals significant volatility and disagreement between bullish and bearish investors. Though often seen as bearish due to its volatility and uncertainty, its historical performance makes it ambiguous. A megaphone pattern consists of a minimum of two higher highs and two lower lows. Web the megaphone pattern is a relatively unique chart formation characterized by higher highs and lower lows, forming a broadening wedge shape. This can be a bullish or bearish pattern, depending on whether it slows upwards or downwards. Web “bitcoin next point to complete the weekly megaphone price pattern is $69k,” crypto trader milkybull crypto claimed. Each has a proven success rate. Web a megaphone pattern is when price action makes a series of higher highs and lower lows over a period of time. Web megaphone patterns present two trading opportunities:Learn To Spot The Megaphone Pattern • Asia Forex Mentor

Megaphone Pattern The Art of Trading like a Professional

Bearish and Bullish Megaphone pattern A Complete Guide ForexBee

Bullish Megaphone & Bearish Megaphone Chart Pattern Stock Market

What is the Megaphone Pattern? How To Trade It.

What is the Megaphone Pattern? How To Trade It.

Megaphone Trading Strategy The Forex Geek

Megaphone Pattern The Art of Trading like a Professional

Megaphone Chart Pattern Explained! (Technical Analysis Trading Stocks

Megaphone Pattern The Art of Trading like a Professional

Web Published Research Shows The Most Reliable And Profitable Stock Chart Patterns Are The Inverse Head And Shoulders, Double Bottom, Triple Bottom, And Descending Triangle.

The Bullish Pattern Is Confirmed When, Usually On The Third Upswing, Prices Break Above The Prior High But Fail To Fall Below This Level Again.

This Can Be Both A Bullish Or Bearish Pattern Depending On Whether It’s Sloping Upwards Or Downwards.

Broadening Formations Indicate Increasing Price Volatility.

Related Post: